Sell with a 30 day Guarantee

by Andrew Georgitsis

In 2025, the Southern California housing market has shifted in favor of buyers. Homes are taking longer to sell, and buyers have more options, making it crucial for sellers to adopt strategies that make their listings stand out. The Current Market Landscape Recent data indicates that homes in Southern California are staying on the market longer than in previous years. For instance, in San Diego, the average time on the market increased to 47 days in May 2025, up 10 days from the previous year . This...

Read MoreSteps to Home Buyers 2% Cash Back Rebate

by Andrew Georgitsis

Buying a home in California is an exciting journey, but it can also be a costly one. At SoCal Reatly and Investments, we believe in rewarding our clients for choosing us. That’s why we offer our Cash Back Real Estate Rebate, where buyers can receive up to 2% of our commission back at closing! This rebate puts thousands of dollars back in your pocket, making homeownership more affordable and accessible. What is the SoCal Realty and Investments Cash Back Rebate? Our rebate...

Read MoreIntroduction to SoCal Realty and Investments

by Andrew Georgitsis

A Bit About Me I grew up in South Africa and moved to the United States in 1986 to pursue the American Dream. I hold a B.S. in Computer Science and a B.A. in Business Management from the University of Puget Sound (1991). Since graduating, I’ve been an entrepreneur, first in the scuba diving industry where I worked closely with the public as both an educator, retailer, inventor, guide and ultimately developer. In 2008, I relocated from San Fransisco to the San Diego area and transitioned...

Read MoreWhat happens when you overprice your home?

by Andrew Georgitsis

What happens when you overprice your home? When the real estate market favors sellers, it’s almost like there’s a feeding frenzy among buyers trying to secure listings that seem to get snapped up within hours of being put on the market. Such demand drives the prices of homes up rapidly, which only feeds into the perception that the good times will last forever. Unfortunately, trees don’t grow to the sky and there will always be a top of the market. What this means is...

Read MoreWhy Getting Pre-Approved Is Your First Step to Homeownership Success

by Andrew Georgitsis

Why Getting Pre-Approved Is Your First Step to Homeownership Success Turning Dreams into Reality Without the Nightmares Buying a home is a dream many share, but the journey from aspiration to acquisition can be fraught with challenges if you're unprepared. In today’s dynamic real estate market, getting your offer accepted isn't just about finding the right property—it's about presenting yourself as the ideal buyer. Let's navigate this journey together, ensuring...

Read MoreWhy You Should Have A Home Inspection Before You List

by Andrew Georgitsis

Why You Should Have A Home Inspection Before You List One of the largest home sale killers is the home inspection. Nearly one-third of all terminated real estate contracts fall apart because of the inspection results. Inspections also ranked as the number three cause of delayed settlements, accounting for 13 percent. For some reason - and I’ll never get it - a home inspection that comes back with anything less than a perfect report strikes fear into the hearts of buyer agents and...

Read MoreYour home is under contract, what’s next?

by Andrew Georgitsis

Your home is under contract, what’s next? Great news, you’ve put your dream home under contract and you’re excited to move in one day soon. That said, there’s a lot that has to happen before you can take occupancy: home inspection, appraisal, financing paperwork, contingencies and other requirements necessary to close. Here’s what you can expect to happen over the coming weeks. Due Diligence Now that the home is yours to negotiate...

Read MoreWhat will be your payment on your new home?

by Andrew Georgitsis

What Will Be Your Payment on Your New Home? Taking Charge of Your Financial Fitness Buying a new home can feel overwhelming—much like starting a new fitness regimen. Between understanding the financial aspects of your mortgage and navigating the paperwork, it's easy to feel lost. But just as you wouldn't embark on a fitness journey without a plan, you shouldn't dive into homeownership without understanding the key components that will affect your financial health. Understanding...

Read MoreHow much you should put down to purchase your new home?

by Andrew Georgitsis

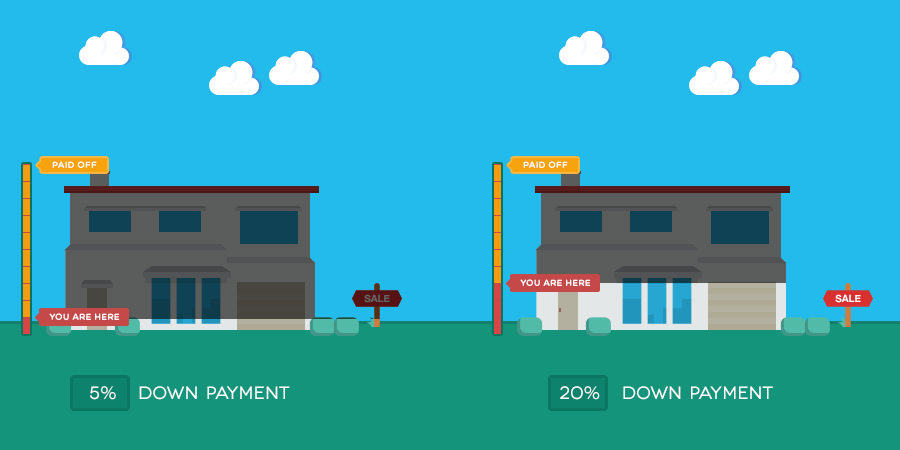

How much should you put down to purchase your new home? Historically, home buyers seek to put down 20% when they purchase a home. However, according to a recent survey by The National Association of Realtors (NAR), the actual national average is much closer to 10%. When it comes to first-time homebuyers, the average down payment is at 4% as per the same survey. While down payment requirements vary based on the lender you choose to work with, the amount required will usually depend...

Read MoreWhy You Should Get a Home Warranty When You List Your Home

by Andrew Georgitsis

Why You Should Get a Home Warranty When You List Your Home Home warranties aren’t just for buyers anymore. In the past, buyers have asked sellers to pay for a home warranty to give them a year of protection after it sells on roughly 16 major systems in the house including things like the electrical system, appliances, hot water heater, furnace, etc. Overall, it makes sense because the first time claim on a home warranty for most buyers runs around $1,500 to 1,600 plus a deductible...

Read More